The American Express Hilton Aspire card is a premium credit card that belongs in your wallet. It has a hefty annual fee, but the card comes with a plethora of benefits. I have had the card for several years and I happily pay the annual fee for it every year. After reading this, I’m hoping that you will too.

Post Updated: March 2, 2024

Table of Contents

- 1 Sign Up Bonus

- 2 Spending Category Bonus

- 3 AmEx Hilton Aspire Benefits

- 3.1 Hilton Honors Diamond Status

- 3.2 Weekend Free Night Award

- 3.3 $250 $400 Resort Credit

- 3.4 Waldorf Astoria/Conrad Credit

- 3.5 $250 $200 Airline Credit

- 3.6 Priority Pass Select Membership

- 3.7 No Foreign Transaction Fees

- 3.8 NEW BENEFIT: $189 Clear Credit

- 3.9 NEW BENEFIT: National Car Rental Executive Status

- 4 AmEx Hilton Aspire Annual Fee

- 5 Apply for the American Express Hilton Aspire Card

Sign Up Bonus

The current sign up bonus, as of June 4, is 150,000 Hilton Honors points after spending $6,000 in the first six months. I know that seems like a lot of points, and it is a decent amount. However, some of the high-end Hilton properties are 90,000 points per night. On the flip side, I’ve seen some places as low as 20,000 points.

Spending Category Bonus

Hilton Honors points are among the easiest points to earn. The Hilton Aspire card earns 14 points per dollar at Hilton properties, 7 points per dollar for flights, rental cars, and restaurants, and 3 points per dollar for everything else.

AmEx Hilton Aspire Benefits

There are a ton of benefits that this card comes with right off the bat. It might seem overwhelming, but it isn’t that confusing if you break it down.

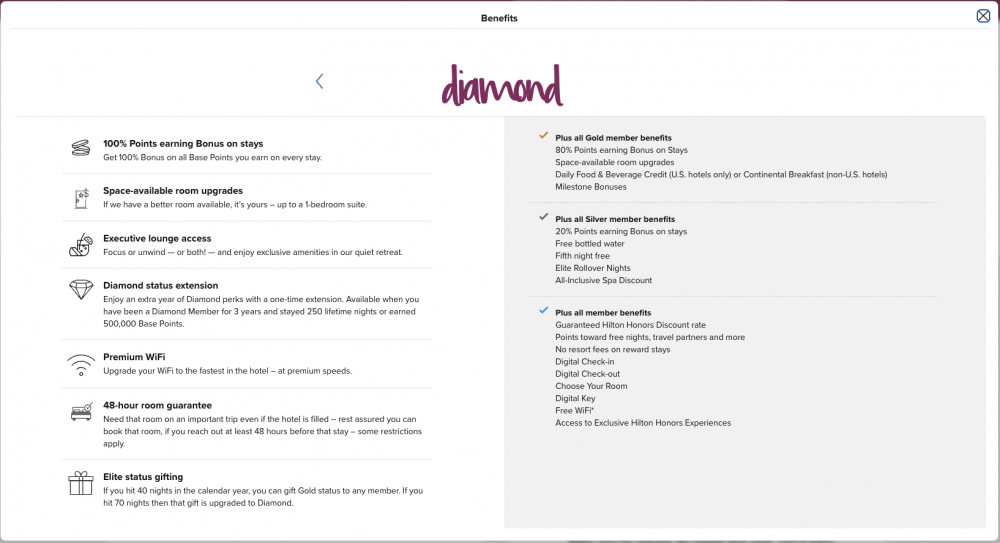

Hilton Honors Diamond Status

This is the highest elite level in the Hilton Honors program. You get free breakfast (at properties outside the United States) or a food & beverage credit at properties within the United States, room updates, 100% bonus points on based points earned at Hiltons, and premium wifi.

There may be other benefits offered by specific Hilton properties, but those are the main benefits of having Diamond status.

Weekend Free Night Award

Every year, including the first year you have the card, you earn a free night that can be used on any weekend night at nearly any Hilton property worldwide. This can be used at a Waldorf Astoria where room rates are hundreds of dollars! This benefit alone may already outweigh the annual fee!

It is possible to earn a second free night after spending $60,000 within a calendar year. In my opinion, it isn’t worth the opportunity cost. You would likely have a better return putting that amount of spend on a different card, such as the Chase Sapphire Preferred.

$250 $400 Resort Credit

Each year you have the card, you can get a statement credit for up to $250 (including the room rate) at a Hilton resort, such as the Hilton La Quinta Resort.

Update: Instead of the $250 resort credit each calendar year, the card comes with a $200 resort credit each half year! If you’re staying at Hilton resorts then this is quite the upgrade!

It is also possible to make use of both credits on one stay. If you don’t have a vacation planned for one half of the year but you do for the second half (or the first half of the next year), you can charge $200 before your stay. Call the resort and ask for a credit authorization form. When you send it back, let them know you want $200 charged immediately. When you enjoy your stay, you will have that as a credit in addition to the current half-year credit. For example, I stayed at the Waldorf Astoria Monarch Beach on New Year’s Eve. I hadn’t used my $250 resort credit last year. This was before this change, and it expired in mid-December. I preauthorized $250, and the property charged my card before my stay. Since my checkout was on January 1, I had an additional $200 in credit that I could use!

Waldorf Astoria/Conrad Credit

When you stay two or more nights at a Waldorf Astoria or Conrad hotel, you also get a $100 statement credit. This can be stacked with the previously mentioned resort credit!

$250 $200 Airline Credit

Each calendar year, you get a $250 airline credit. Annoyingly, American Express makes it not as easy to use as Chase does with the Sapphire Reserve. With the Hilton Aspire card, you have to specify the airline to use it on before you can make use of it. It is only good for incidental charges such as baggage fees, inflight food or drinks, or seat assignments.

Update: The benefit has changed to a $50 credit each quarter. Also, instead of needing to use it on incidentals, it can be used to book flights directly with the airline or via the AmEx Travel portal!

Priority Pass Select Membership

Access select airport lounges for you and two guests. Unfortunately, this does not include participating restaurants that the Priority Pass membership that the Chase Sapphire Reserve gives you.

No Foreign Transaction Fees

No surcharges when paying for charges in foreign countries. The surcharge is typically around 3%, so this benefit can save you quite a bit of money.

NEW BENEFIT: $189 Clear Credit

Clear is a service at most domestic airports and some sports venues that allows you to skip the security line. Sometimes there is a line for Clear, but often the regular security line is longer. With a simple eye or fingerprint scan, you’re escorted to the front of the line and you’re on your way.

A Clear membership costs $189 so this benefit makes it free. There are often free trials and discounts but with the American Express Hilton Aspire card, I don’t bother with them.

NEW BENEFIT: National Car Rental Executive Status

National Car Rental is one of my favorite car rental companies. Having Executive status allows you to pick any car in the Executive aisle as long as you reserve a midsize car. I have gotten Alfa Romeos, Audis, Cadillacs, and BMWs on multiple occasions!

AmEx Hilton Aspire Annual Fee

The annual fee on the Hilton Aspire card is $450. Obviously, it may not be possible to make use of all of the benefits, but I’m confident that making use of just a handful of the benefits will make up for the annual fee.

Update: The annual fee has gone up to $550. This is unfortunate, but the new and revamped benefits make up for it. The airline credit is much easier to use than it was before.

Here is just one example that makes up for the high annual fee. If you stay at a resort for one night, and spend $200, twice a year. That’s already $400 in value. I’m not even including the value of having Diamond status for that stay.

When you add the airline credit for both calendar years and the value of the points from the sign up bonus, it adds up to over $1,000 for the first year of having the card.

Don’t cancel it after the first year! The free night, resort credit, and airline credit are enough to make me think the Aspire card is well worth the annual fee. Despite the changes, I still think this card is worth it if you’re over 5/24.

Apply for the American Express Hilton Aspire Card

150,000 Hilton Honors points after spending $6,000 in the first 6 months

Free weekend night certificate annually

$400 resort annual credit

Hilton Honors Diamond status

$200 airline credit annually

and more…